Applications related to financial transactions or containing personal data

Such as mobile banking applications or online shopping platforms which we are familiar with.

Setting up

two-factor authentication on these applications or platforms can better protect the user’s credentials. In addition,

two-factor authentication can prevent unauthorized access to the user’s account. This allows us to deal with any potential problem in a timely manner.

Why are passwords no longer enough?

When logging in to systems, in particular financial systems, identity authentication is a must. This step is very important as it will confirm the real account owner. These days, however, input of password is no longer enough, as hackers may be able to

guess your password or trick you into entering the data via a phishing website (

Phishing

), or may even impersonate unsuspecting users to conduct unauthorized transactions

with ease.

If passwords are not enough, what can we do to ensure that unauthorized access to the system will not occur? Are there any other methods for identity authentication?

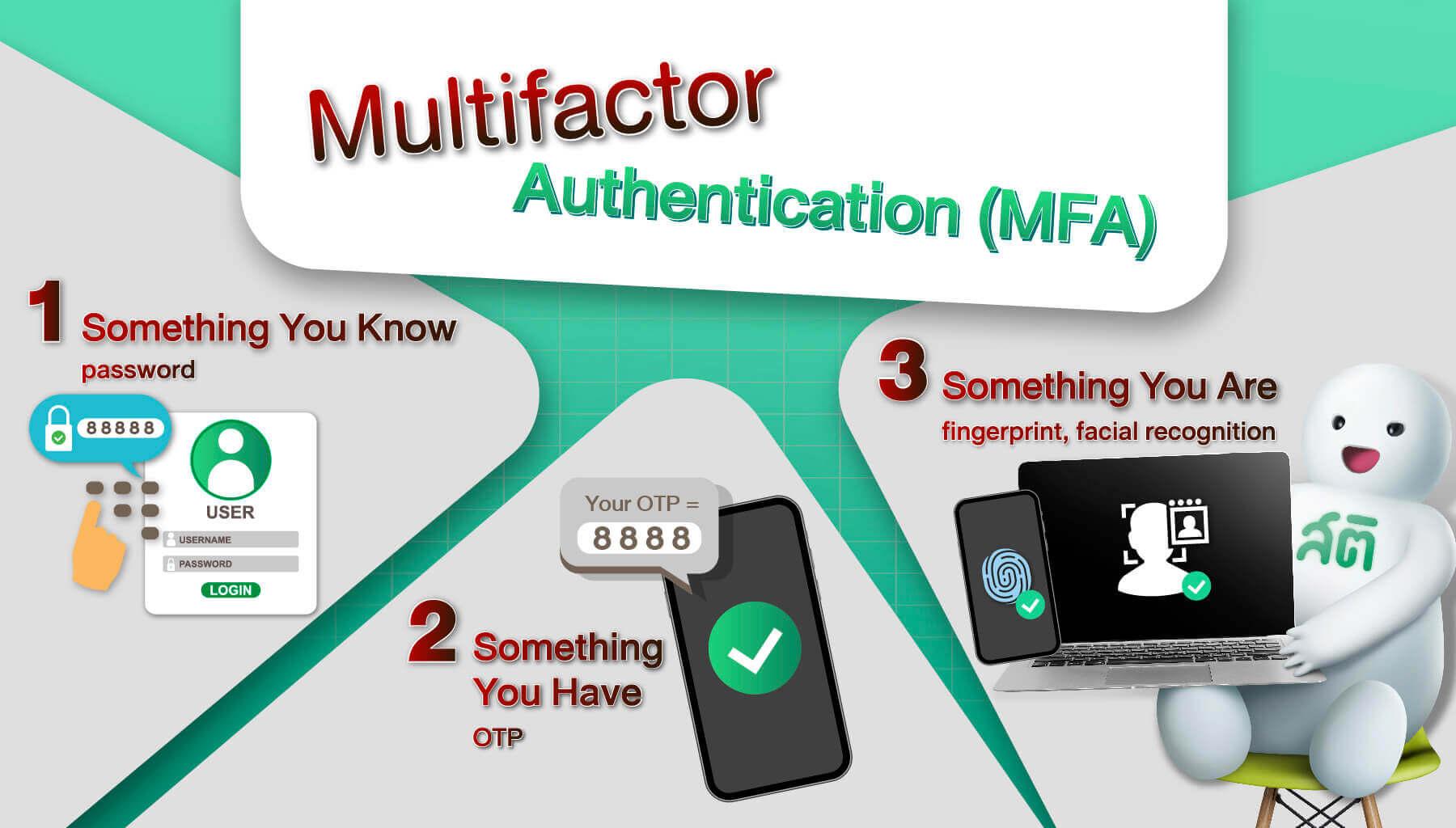

Get to know Multifactor Authentication (MFA)

To add an extra layer of security to your identity, the use of multifactor authentication requires three verification factors

as follows:

1.Something You Know

Such as password or PIN code, which is familiar to many of us. This step requires you to enter your username

and password

in order to log in to the system.

2.Something You Have

Such as one-time password (OTP) that is obtained from SMS or email, national ID card, SIM card, token, etc.

These are held by their owner only.

3.Something You Are

Or biometric data of each individual person such as fingerprint, facial recognition, retina scan or even voice recognition.

This data is often used for unlocking a mobile phone screen.

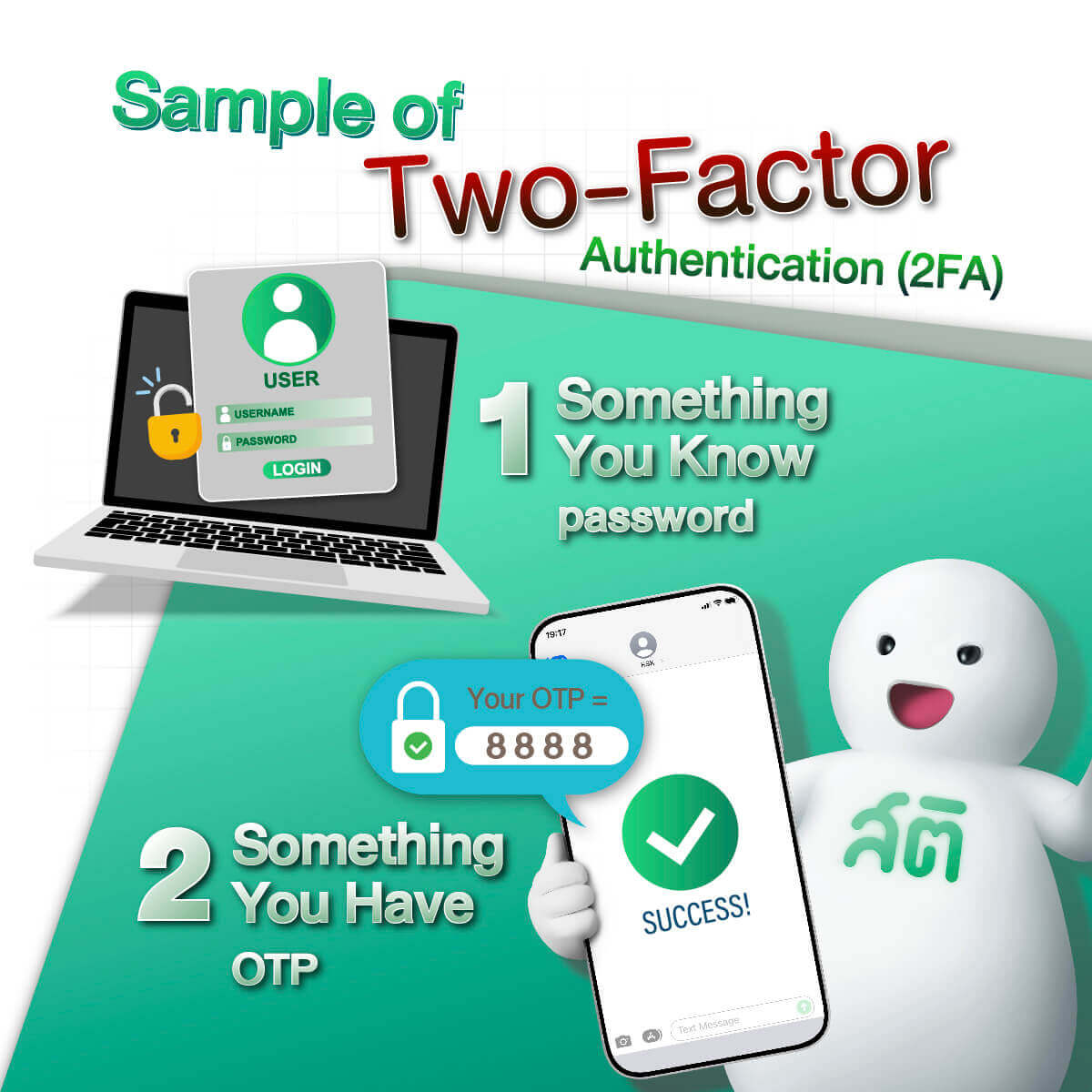

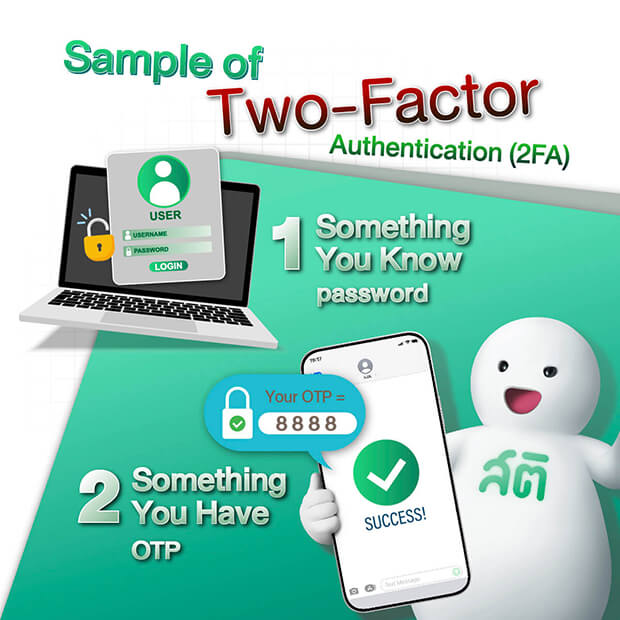

Identity authentication as used in our daily lives usually involves conducting transactions that are exposed to risk. For instance, funds transfer or change in personal data usually requires two of the three factors as aforementioned. This step is called

two-factor authentication (2FA).

Simply put, 2FA is another form of MFA.

Example of two-factor Authentication (2FA)

As mentioned earlier, 2FA requires two verification factors for identity authentication. To make it clearer, let’s use online shopping as an example as it is among the most commonly seen transactions that require 2FA. After logging in to an online shopping platform/system with username and password, shoppers are required to enter an OTP received from SMS to make payment to complete that transaction.

As evidenced, 2FA is common to us as we use it in our daily lives.

Surely you have opened an online account with 2FA activated.

Which services require MFA??

-

-

Social Media Account

As social media is widely used for making money these days, account security is vital. If you’re unlucky enough to have your Facebook, Twitter, Instagram or YouTube account hacked, your income-earning channel could be totally cut off! -

Emails

Email hacking is more common than you think. Many people get hacked via email as they tend to pay less attention to this channel. As a matter of fact, email address is used as an account for registering in various platforms/systems. Signing up for a social media account also requires an email address. Bear in mind that if your email is hacked, your social media might be compromised as well.

Now you may have greater peace of mind as you have added an extra layer of security to your account. So don’t forget to share these simple tips with your loved ones so that they may also avoid falling prey to cyber scams!